Our Projects Will Add Value To Nigeria’s Economy-Shell

Mohammed Shosanya

The Chairman of Shell Companies in Nigeria (SCIN), Mr. Osagie Okunbor conveyed the company’s determination to take the Final Investment Decision (FID) on some of the major projects in 2024, which would benefit the Nigerian oil and gas industry and the national economy.

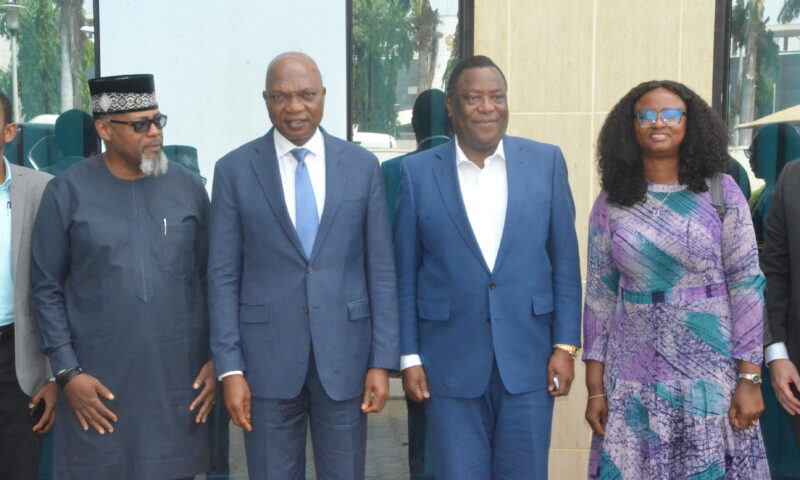

He spoke when when he led the delegation of Shell Companies in Nigeria (SCIN),on a visit the Nigerian Content Development and Monitoring Board (NCDMB) Engr. Felix Omatsola Ogbe

He clarified that the planned divestment by Shell Petroleum Development Company (SPDC) would not affect any contract duly entered by the company, while the major projects in the pipeline, especially the gas projects would be developed under SNEPCo

He added that the divestment was a business realignment and would only affect the shareholding structure of the company, while the operations and staff would remain intact.

Speaking on the new projects, Okunbor indicated that the Bonga North project would be a tie-back project that would unlock about 350 million barrels of oil equivalent and extend the life of Bonga Floating Production Storage and Offloading (FPSO) for another 15 years.

He mentioned that the company had made appreciable progress in the plans for HI and HA projects which would supply 50 percent of the gas required for the successful operation of the Train 7 project currently being developed by the Nigeria Liquified Natural Gas (NLNG) Company.

He underscored the need to develop the gas projects speedily, to avoid delaying the Train 7 operation date. While thanking NCDMB for its support for the company’s various projects, Okunbor requested the Board to fast-track the approvals on the new projects to enable the projects to proceed to full execution.

He stated that the economics of the projects were challenging, making it imperative to carefully manage the expenditures for in-country and out-of-country scopes of the project.

The Country Chair also congratulated the Executive Secretary on his appointment and conveyed the enduring support of Shell Companies in Nigeria to the delivery of the Board’s mandate and continued performance as the number one federal agency in the country.

He also commended the Executive Secretary for his avowed vision to improve the speed of the Board’s approval processes to enable the development of new oil and gas projects.

In her comments, the Managing Director of SNEPCo, Mrs. Elahor Aiboni reiterated the company’s plan to develop the Bonga North project as fast as possible, to increase the country’s crude oil production.