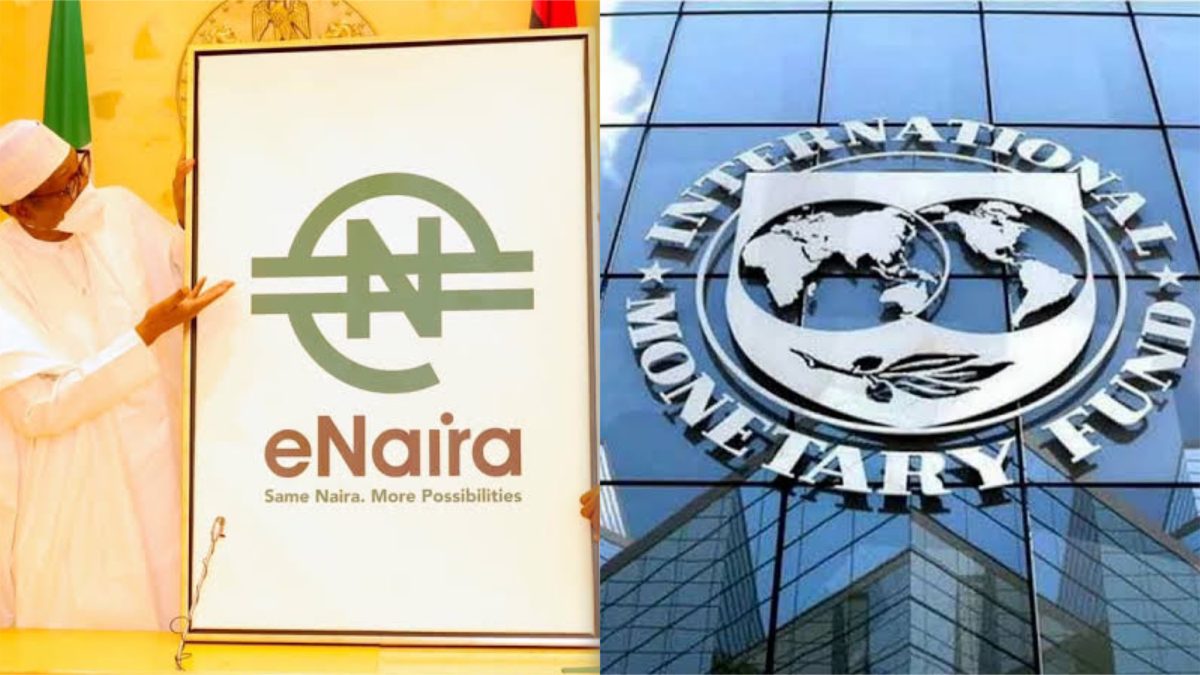

The International Monetary Fund, IMF, has offered to provide technical assistance and policy advice to the Central Bank of Nigeria, CBN, on the evolution of the eNaira.

The IMF stated this in a report, titled, “Five Observations on Nigeria’s Central Bank Digital Currency”,

The institution noted that while the e-Naira has the potential for financial inclusion and boost Diaspora remittances, it is also vulnerable to cybersecurity and operational risks on account of its reliance on digital technology.

The IMF conveyed its position on e-Naira in a report, titled, “Five Observations on Nigeria’s Central Bank Digital Currency”,

It implored the CBN to watch the product with a view to properly managing risks that may arise from the initiative.

The Fund said Nigeria is among the key remittance destinations in sub-Saharan Africa, with remittance receipts amounting to $24 billion in 2019.

According to the Fund, remittances typically are made through international money transfer operators (e.g., Western Union) with fees ranging from 1 percent to 5 percent of the value of the transaction.

It added:“The eNaira is expected to lower remittance transfer costs, making it easier for the Nigerian diaspora to remit funds to Nigeria by obtaining eNaira from international money transfer operators and transferring them to recipients in Nigeria by wallet-to-wallet transfers free of charge.

“Exchange rate reforms, including a unified market-clearing rate, that reduce the gap between official and parallel market exchange rates would enhance the incentives for using eNaira wallets to send remittances.”