Nigeria spent N2.02 trillion on debts servicing between January and June, 2021, Technical Adviser to the Director General of the Budget Office of the Federation, Alfred Okon has said

Okon disclosed this at a training on “Government Integrated Financial Management Information System Budget Preparation Subsystem For Ministries, Department and Agencies in Abuja

According to him, the figure represents 90.5 per cent of the total revenue of N2.23tn generated by the federal government within the same period.

He said as of June 2021, the federal government’s retained revenue was N2.23tn, which is 67.3 per cent of pro-rated target of N3.3tn for the review period.

He added that the total revenue comprises oil revenue of N492.44bn, non-oil tax revenue of N778.18bn, Company income tax of N397.02bn, Value Added Tax of N129bn and Customs collections of N234.02bn.

Other revenues amounted to N922.09bn, out of which independent revenue from Ministries, Departments and Agencies of government was N558.13bn.

He noted that the N2.02tn used to service debt in the first half of this year represented 35 per cent of total expenditure of N5.81tn.

He said: “On the expenditure side, N5.81tn (representing 92.4% of the prorated budget) has been spent. This excludes GOEs’ and project-tied debt expenditures.N2.02tn was for debt service (35% of Federal Government expenditures); and N1.795tn for Personnel cost, including Pensions (30.9% of FGN revenues).”

He also said as of August, N1.3tn had been released for capital expenditure, representing 22.3 per cent of total expenditure.

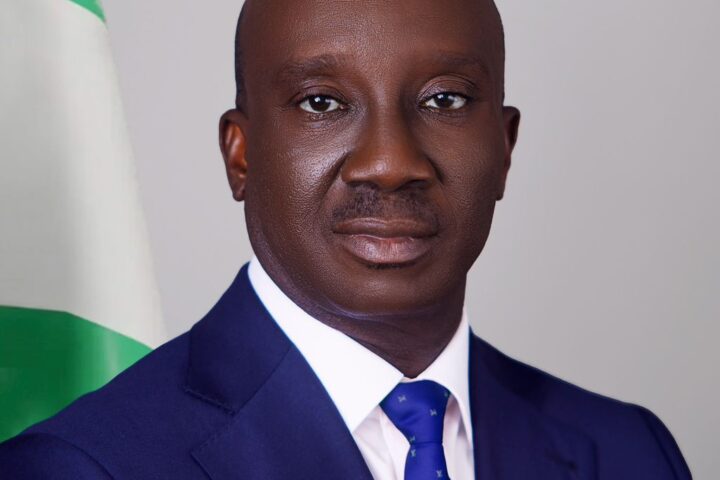

Earlier in his remarks, the Director General , Budget Office, Ben Akabueze, expressed government’s commitment to ensure the timely submission and approval of the 2022 budget.

He said the government has already deployed a series of activities including engagements and stakeholder consultations.

He added:“The current federal government is determined to ensure consistent and timely preparation, submission and approval of annual budgets as part of its Public Financial Management (PFM) reforms, just as we have done for the 2020 and 2021 Budgets.To achieve this, we have already commenced a series of activities related to the process of preparing the 2022 Budget.

“These include a series of engagements and stakeholder consultations with key revenue generating agencies, civil society organisations (CSOs), the National Executive Council (NEC), the National Assembly as well as the Federal Executive Council (FEC).Another key activity on the 2022 Budget Calendar is the training of MDAs’ personnel who will be involved in budget preparation”