The Federal Inland Revenue Service (FIRS) has appealed a recent judgment of the Federal High Court in Port Harcourt Rivers State on the issue of Value Added Tax (VAT)collection.

The agency conveyed the court action in a statement by its Director, Communications and Liaison Department, Abdullahi Ismaila Ahmad.

He informed that the Federal Inland Revenue Service has lodged an appeal against the judgment of the Federal High Court Port Harcourt Judicial Division delivered by Honourable Justice Stephen Pam, in suit number FHC/PH/CS/149/2020-Attorney-

He also said his agency has sought an injunction pending appeal and a stay of execution of the said judgment.

He added:”As the decision is being appealed and in view of the pending applications for injunction and stay of execution which the FIRS has filed in court against the judgement, members of the public are advised to continue complying with the Value Added Tax obligations until the matter is resolved by the appellate courts in order to avoid accruing the consequent penalties and interest for non-compliance.”

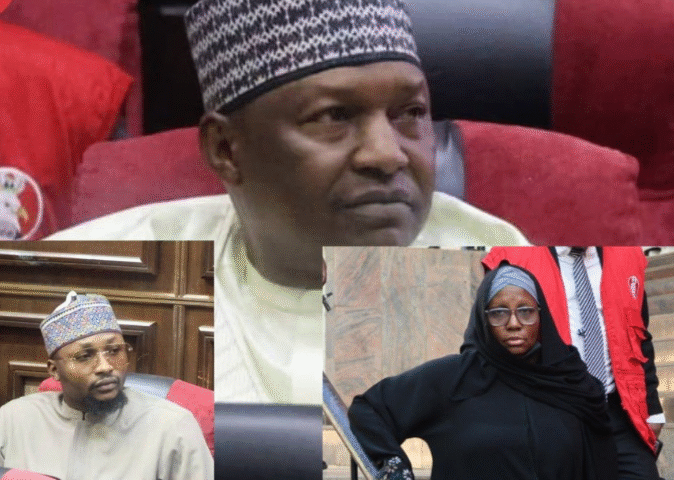

Meanwhile,the Senate has ordered the Executive Chairman of Federal Inland Revenue Service (FIRS), Muhammad Mamman Nami, to go after defaulting agencies to recover the sum of N17 billion allegedly owing by the management of FIRS and remit it into Consolidated Revenue Fund (CRF) within 90 days.

Directing the Chairman of FIRS to recover the money and pay to the Consolidated Revenue Fund, while adopting the report, the Senate also ordered for blacklisting of all companies that failed to file their annual returns.

It said: “Evidence of compliance should be forwarded to the Public Accounts Commitee.”