The Central Bank of Nigeria said cumulative refund by banks to customers as at December ending 2021 stood at N95.2 billion.

This is contained in data released by the bank at the opening ceremony of the bank’s 2022 fair held in Jalingo, Taraba State.

It urged the public to always lodge complaints with banks over service-related issues, adding that cumulative complaints from customers as of December 2021 was 27,080

The bank disclosed that 25,483 complaints were successfully resolved.

Branch Controller of CBN in Jalingo, Mr. Idris Dagona,who spoke at the fair said, the Fair was aimed at having an enlightened public and receiving feedback that would enrich future policy reviews and developments.

“The sensitization will also highlight the position of the Bank as a dynamic organisation with a view to promoting confidence in the economy, improve the standard of living for all Nigerians, thereby making CBN a proactive regulator.

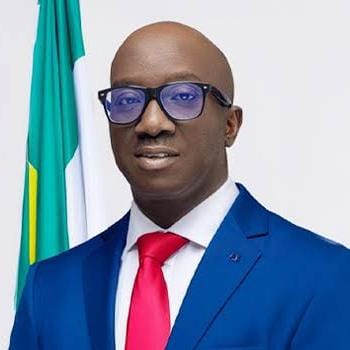

Meanwhile,the Governor, Central Bank of Nigeria, Mr Godwin Emefiele, has said that 23 banks Chief Executive Officers, representing 35 per cent banks’ leadership are women.

He disclosed this while addressing participants at a webinar organised by the Deputy Governor in charge of the Financial System Stability Directorate, Mrs Aishah Ahmad, as part of activities to commemorate the 2022 International Women’s Day at the CBN.

He said the bank, in an effort to increase representation of women in the industry, had been using the gender diversity model as part of the criteria for approving the membership of boards of institutions under its regulatory purview.

He added that such gender mandates was necessary to break the bias in the Nigerian banking industry, and that; ‘eight out of the 23 bank chief executive officers, representing 35 per cent, were women, which was way above the global average.”

According to him, 32 per cent of the CBN’s total workforce are female, which surpasses affirmative action.

He also said that the bank has issued gender-mandated regulations to pave way for gender diversity and inclusiveness at the top management levels in the Nigerian banking industry.

The CBN, he noted, had also issued a policy that requires a minimum of 30 per cent of female representation on boards and 40 per cent at the top management level in the banking industry.