The Central Bank of Nigeria (CBN) has disbursed about N81 billion in rebates to Nigerian exporters.

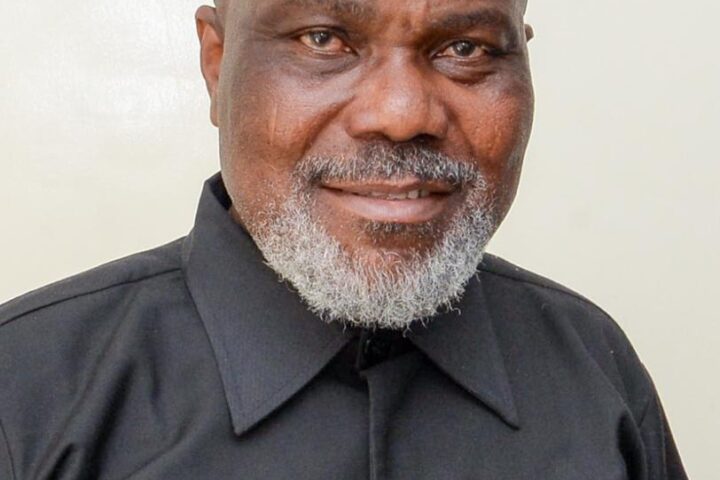

Governor of Central Bank of Nigeria,Godwin Emefiele spoke on Tuesday in Lagos at the second Edition of the RT200 bi-annual conference with the theme: “RT200 Non-Oil Export Program: The Journey So Far”.

He noted that of this amount, only $1.966 billion qualified for the rebate program, but only $1.559 billion was sold at the Investors and Exporters (I &E) window or for own use.

He said events in the last three quarters have shown that when the bank makes a commitment, it keeps that commitment to the latter.

“I know that there have been calls to make all exporters eligible for the rebate, and not just limit it to finished and semi-finished products.While we see some justification for this, one of the goals of the RT200 program is to help quicken the process of industrialization and encourage exporters to earn more from their export business,” Emefiele stated.

He said the conference looks at what has been achieved since the first summit and the result of the collaborative efforts by all stakeholders in the export value chain as well as areas for further improvement and collaboration.

He said for exporters, flying the flag of Nigeria in the international market,the Bankers’ Committee and the CBN stand ready to partner with them to achieve their goals.

He said exporters can benefit from the many financial programs introduced by the CBN through their bank to grow their businesses.

He also said export can transform the economic structure of countries, from simple, slow-growing, and low-value activities to more productive activities that enjoy greater margins driven by technology.

He added:“We must help our exporters and our economy by adding value to what we produce and export. We are already getting feedback from banks on the interest of exporters to add value to the products they export in order to allow them to benefit from the program.

“We are happy that this is happening, and we encourage more exporters to find ways to add value to their export products so that they can benefit not only from the scheme but get better value for their exports.

“We are already getting feedback from banks on the interest by exporters to add value to the products they export in order to allow them to benefit from the program. We are happy that this is happening, and we encourage more exporters to find ways to add value to their export products so that they can benefit not only from the scheme but get better value for their exports.”