Central Bank of Nigeria (CBN),says it was looking beyond monetary policy measures to fix the country’s foreign exchange crisis.

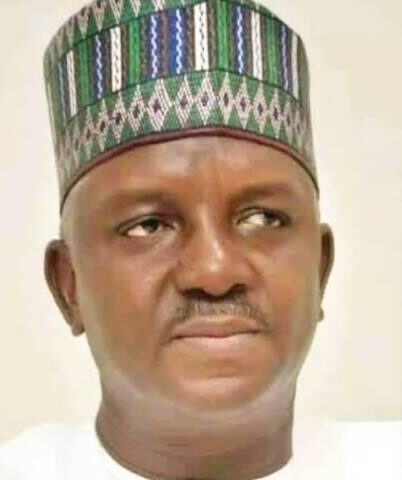

The bank’s governor,Godwin Emefiele,who disclosed this at the maiden bi-annual Non-Oil Export Summit in Lagos, said monetary policies cannot sufficiently address the problem in the face of rising demand for foreign exchange for goods, services and other needs.

He described the RT200 FX Programme recently unveiled by the apex bank as one of such strategies.

Emefiele listed value-adding exports facility; non-oil commodities expansion facility; non-oil fx rebate scheme; dedicated non-oil export terminal and biannual non-oil export summit as the five pillars anchoring the programme.

He said the CBN has been working overtime to manage the demand and supply side to meet foreign exchange obligations.

Emefiele,who attributed the prevailing challenges of the local economy to COVID-19 pandemic, delays in global logistic value chains and local security challenges,expressed concern that the current sources of foreign exchange inflows were unreliable and prone to fluctuations of global economic developments.

He noted that the global economic challenges have impacted food production among others and exerted undue pressure on the economy, thereby exposing the fragility of the Nigerian economy and making macroeconomic management very difficult.

He emphasized the need for a more diversified economy, adding that monetary policy alone could not bear all the burden of the expected adjustments needed to manage the challenges to the Nigerian economy.

He added : “These problems call for urgent design and steadfast implementation of other supportive, structural and complementary policies that are broad based, coordinated and focused on complementing the work of the monetary authority.”

He implored all stakeholders to regroup by working together to reposition Nigeria on a growth trajectory by taking diversification of the economy much more seriously, emphasising that Nigeria had very little choice left but to look inwards and find innovative solutions to its challenges.

According to him,in order to avoid sudden adjustments to nation’s economic life, there was need to focus on strategies that can help the country earn more stable and sustainable inflows of foreign exchange.

He said: “We would need to follow the best practices of other countries and ensure that we protect ourselves a little bit from factors that are beyond our immediate control.

“This is the time to start working in synergy for the good of our nation. This is the time for us as a Banking Community to do more and support exporters who have been flying the flag of Nigeria in the international market space.”