…Says Agric is Nigeria’s Saving Grace

The Central Bank of Nigeria (CBN) has urged Nigerian manufactures whose revenues are naira- denominated to shun dollar loans.

It promised to continue to provide naira funding, advising that where the revenue stream is in naira, dollar loans should be avoided.

The CBN Governor, Godwin Emefiele spoke during a facility tour of Tolaram Group projects manager of the Lagos Sea Port under construction.

He added:“So, for any entrepreneur that wishes to do business in Nigeria, we will provide naira funding and will always advise that particularly if your revenue stream is in naira, such company should avoid taking dollar loans. Take cheap naira loans at single digit interest rate with two years moratorium”.

He assured that the CBN will continue to encourage people to take advantage of such loans to drive industrialisation in Nigeria and get a manufacturing business back alive again.

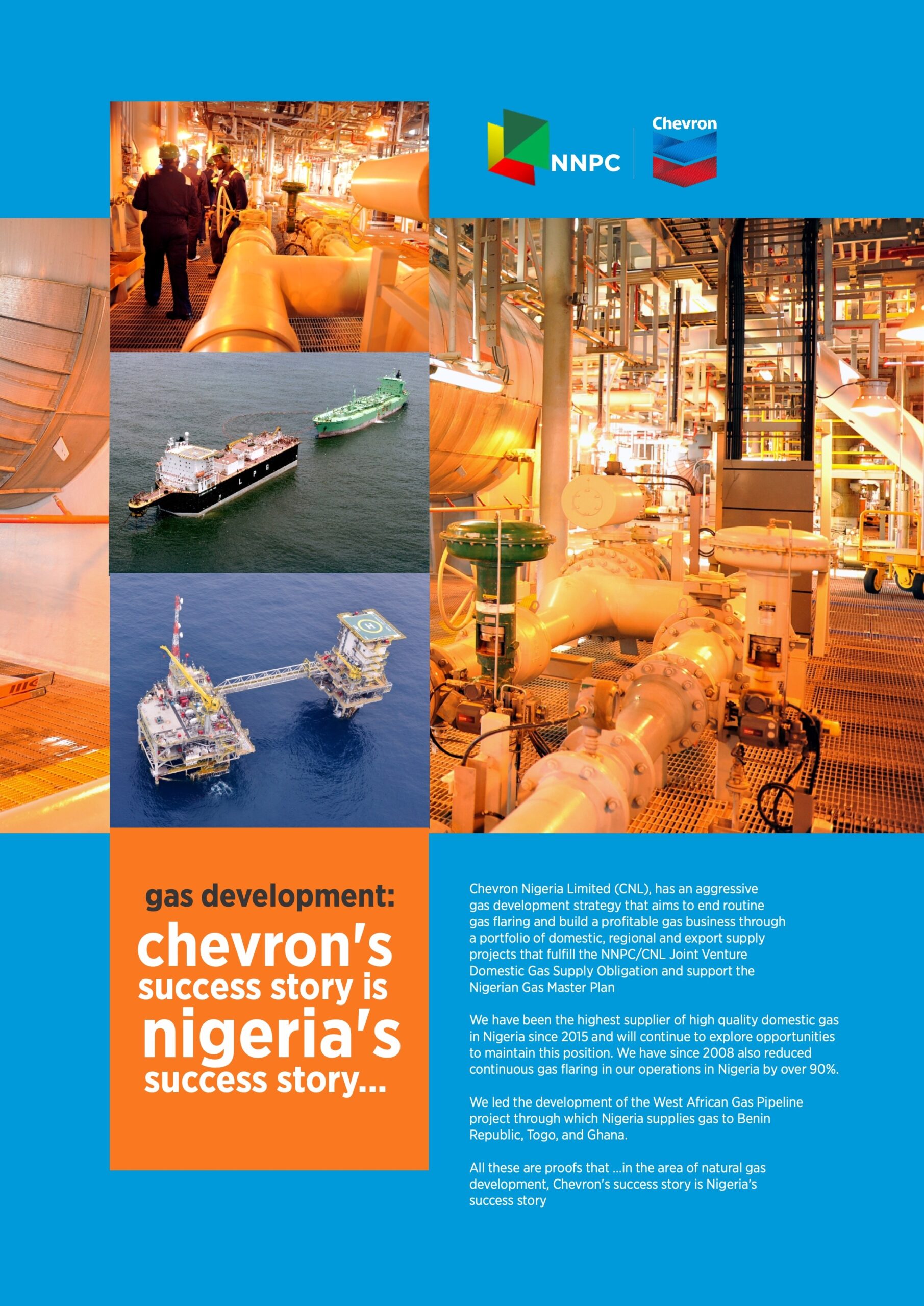

He disclosed that the bank has provided N100 billion intervention fund to Tolaram Group under the Differentiated -Cash Reserve Ratio or through the Commercial Agriculture Credit Guarantee Scheme, which represents only 10 per cent of the N1 trillion, which is about $2 billion, project embarked by the company. “You can see we have sown a seed and we have also given support through making foreign exchange available for them to bring in the equipment to get the Lagos Port operation to work.

“The Tolaram Group has clearly demonstrated that it is one of the largest manufacturing companies with 19 factories in the country. We will not rest on our oars to the extent that we must make sure that whatever you need either Naira loans through our interventions or dollars to import your equipment and plants and the rest of them, we will continue to accord you priority.”

Emefiele also disclosed that Infrastructure Corporation of Nigeria Limited (InfraCorp), Lagos state government and Federal Government will collaborate and begin engagement meant to ensure easy movement of goods out of the Lagos Free Trade Zone. The N15 trillion InfraCorp is co-owned by the CBN, the African Finance Corporation (AFC) and the Nigerian Sovereign Investment Authority (NSIA). “The InfraCorp is chaired by the Central Bank of Nigeria. Its board has been formally constituted, with a CEO in InfraCorp and as soon as we leave this meeting, I will be calling on InfraCorp to begin engagement,” he said.

“I will also be involved in engaging the Lagos state government, as well as the Federal Government as well as the Federal ministry of works see what can be done on evacuating goods out of Lagos, as well as decongesting the traffic for people living around Lekki port axis. I want to give assurance that this is something that would be dealt with. This would be a middle-to-long-term plan. We are happy that this port infrastructure is here and will improve ease of doing business, reduce congestion at the Lagos Tin Can and Lagos Apapa ports.”

He said the apex bank would work with the Lagos Free Zone by having a dedicated export desk that would make it easy for goods to be exported out of the Lagos Port. “That is a very essential thing that we need to deal with, because again talking in a very selfish mode, we need a foreign exchange. If we export, we earn foreign exchange, and I am going to start working with them to ensure that we designate the Lagos Free Zone as an export zone,” he said.

Meanwhile,Governor, Central Bank of Nigeria (CBN), Mr Godwin Emefiele,has expressed satisfaction on the tremendous impact agriculture and the huge role agriculture has played in revitalizing the country in the last six years.

Emefiele disclosed this to journalists during an inspection tour of the palm plantation at Odighi village in Ovia North East Local Government Area of Edo state at the weekend.

He wondered what would have happened to Nigeria if the agriculture sector had not been revamped, vis a vis the rising cost of food items across the globe.

The CBN Governor expressed satisfaction that the Bank has assumed a pivotal role since 2015 upon the pronouncement by President Muhammadu Buhari that “we produce what we eat and eat what we produce” by coming up with several initiatives aimed repositioning the sector with a view to creating employment opportunities as well as growing the the gross domestic product (GDP) of the country.

On his assessment of the farm, an elated Emefiele, expressed joy in the blooming maize and cassava, stating that in the next 12 months, harvests would have commenced.

Acknowledging the significant role played by Edo state Government, thanked Governor Godwin Obaseki immensely for matching words with action by making sure that arable land is made available to those who are genuinely interested in agriculture. He also appealed to other state Governors to emulate Edo state which has So far, made available about 70 per cent of the promised arable land.

He spoke on the socio-economic impact of the CBN interventions, Emefiele singled out the Anchor Borrowers Programme (ABP) among other interventions schemes, which revolutionized agricultural practice whereby small holder farmers who hitherto could not approach commercial banks for loans, are now being granted credit facilities in the forms of inputs like seedlings, fertilizer and herbicides. Those small holder farmers can now cultivate and produce enough for their families and sell produce as loan repayment with ease, thereby generating employment, improving living standards and creating wealth simultaneously. Emefiele also commended the efforts of the promoting company, Agri-Allied Resources and Processing Limited and its parent company, Tolaram Limited for heeding to clarion made by the CBN to source their critical raw materials locally. He noted that the company has painstakingly embraced backward integration principle by acquiring farmland to the tune of 18,000 hectares for cultivation of oil palm, cassava and maize which are the critical raw materials used by the group.