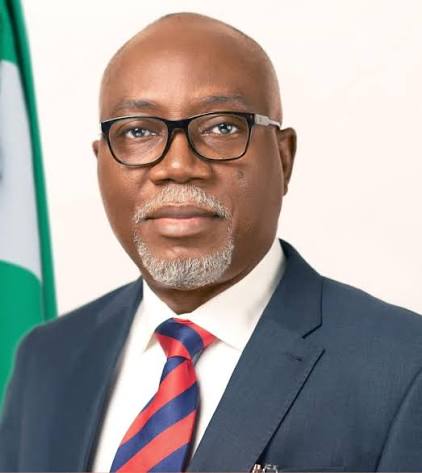

The Chairman of Economic and Financial Crimes Commissions, AbdulRasheed Bawa, has bemoaned increasing corruption amongst bank officials in Nigeria.

He also said different shades of fraudulent activities are perpetrated in financial institutions which are inimical to the nation’s economic growth.

He spoke at the official opening of a three-day capacity building workshop for law enforcement agencies organised by the Nigeria Deposit Insurance Corporation, NDIC, in Abeokuta, the Ogun state capital.

He was represented at the event by the Zonal Commandant Lagos, Ahmed Muhammad Ghali.

Justifying the commission’s recent directive to top executives of banks to start declaring their assets latest by June, Bawa explained that the move was to sanitise the banking sector.

He said the directive was not aimed at witch hunting the bank executives, adding that those who were against the direct were only ignorant of the details of the Bank Employees Declaration of Assets Act.

He assured that his agency would not relent in its efforts to clean the country’s financial institutions.

He added:”We are aware of the different shades of fraudulent activities going on in our financial institutions, particularly in the banking industry sector.In carrying out our mandate of ridding Nigeria of corruption, as mandated by the EFCC Establishment Act, we have realized that there is a slew of corrupt practices going on in the banking sector.

“I recall that upon assumption of office, one of the major pronouncements I made was giving a directive to bankers to declare their assets before June 1, 2021.I had given the directive genuinely out of sincerity of purpose, knowing the rots that permeate the nation’s banking sector.

“In other words, the directive was born out of efforts to sanitize the banking sector. But it was received with mixed feelings.It is obvious that those who kicked or are still kicking against the directive are ignorant of the unmistakable details of the Bank Employees Declaration of Assets Act.”

“Unlike the claims in some quarters, it is not a witch-hunt, rather, it is part of measures to sanitize the country’s financial institutions.In dealing with this situation, the EFCC, under my watch, has intensified its engagement with bank executives, more than ever before.The nation cannot afford to go through another serious crisis in the banking sector; and this explains the constant intervention by the EFCC,” he said.

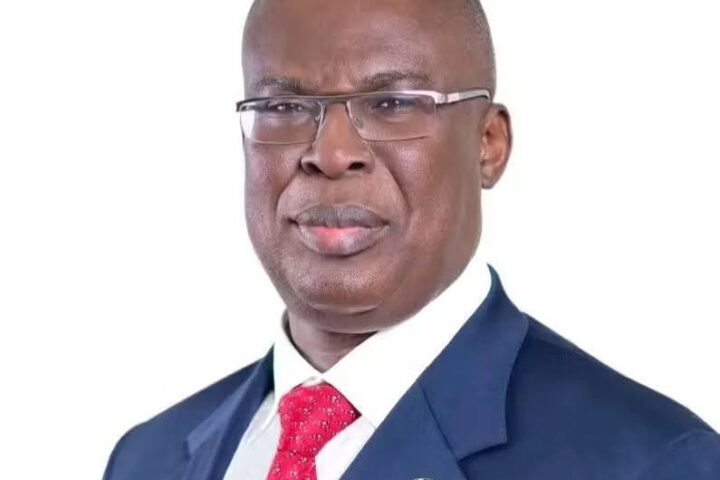

Speaking, Managing Director NDIC, Bello Hassan,blamed failure of banks on the dishonesty act of officials saddled to look after those liquidated banks.

He advocated the need for the investigation and prosecution of supervisors or regulators responsible for the liquidation of any banks,adding that the development will serve as deterrent to others.

He said,:”It is clear that bank failure is not a development that is welcomed by the corporation, it is thus the responsibility of the authorities to ensure that the effect of the action of these culprits is mitigated by bringing such people to book to serve as a deterrent to others.

“It is against this background that the regulators/supervisors and the law enforcement agencies must collaborate and ensure that those who contributed to the demise of banks are thoroughly investigated and if found to have some questions to answer, are duly prosecuted in-accordance with the laws of the land.”