NICON Insurance Plc, AIICO Insurance and others insurance companies have fallen in the Senate trap over failure to remit N17.4 billion Pension Fund to Pension Transitional Arrangement Directorate (PTAD).

The Senate Committee on Public Accounts has summoned NICON Insurance Plc, AIICO Insurance and others insurance companies,to appear before it next Thursday .

The action followed the 2016 report of the Auditor General, which unraveled the non-remittamce of N17.4 billion Pension Fund.

Dr. Chioma Ejikeme, the Executive Secretary of PTAD,took the Senate Committee that PTAD took over the Assets and Liabilities of Defunct Pension offices without a formal handing over .

She said: “On taking over, the Directorates wrote all Underwriters to make returns and remit whatever amount is in their custody into a CBN dedicated account. Some of the underwriters responded to the request while some did not.

“The bank certificate of balances, accounting statements, three years financial statements and policy files requested by the federal Auditor were not handed over to PTAD at the time of consolidation .

“It is worthy to note that the amount stated N17.4 billion comprised of cash, securities and properties from the nine Insurance Underwriters as a result of the letter PTAD sent to them. These figure represent the claims by the underwriters with regards their indebtedness.

“In order to ascertain the true position of legacy funds in custody of underwriters, the Directorate appointed a consultant in 2018 who carried out forensic audit of 9 out of 12 of the insurance underwriters and produced final report on the recovery if the legacy funds and assets for PTAD.

“The insurance companies bare presently disputing the report of the Forensic Audit and some of them are presently subjects of litigation.”

The three insurance companies, who are in Court with PTAD are Standard Life Alliance Assurance, NICON Insurance and Niger Insurance.

Others that are not in court with PTAD are AIICO Insurance, Custodian Life Assurance LTD, Nigerian Life & Provident Company LTD, Custodian Life Assurance, African Alliance, LASSACO Assurance Plc.

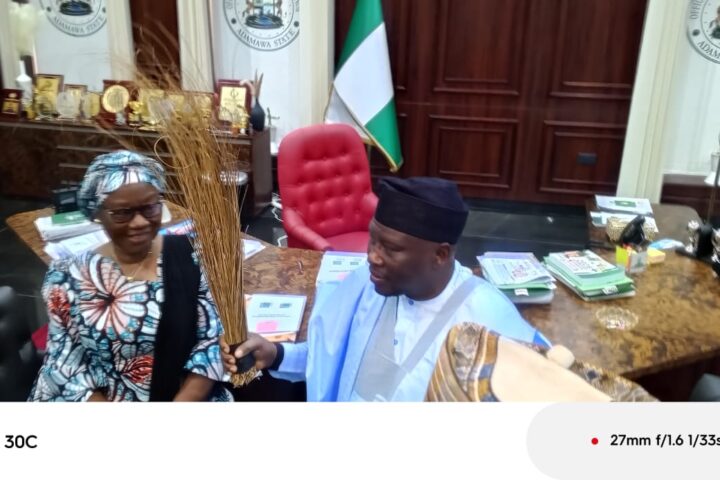

They are all expected to appear before the Committee by next week Thursday based on the resolution of the Committee chaired by Senator Mathew Urhoghide.

The Auditor- General Report had said: “Returns on pension funds totalling N17.4 billion forwarded by the underwriters were not accompanied by the following documents: (i) (ii) (iii) (iv) Bank Certificate of balances as at the close of accounts. Accounting Statement showing the following: (a) (b) (c) Actuarial Value of Assets: Valuation of Assets at the lowest cost. Actuarial surplus: Excess of Assets over Liabilities Actuarial Liabilities/deficiency: Excess of Liabilities over Assets A minimum of 3 years Annual Financial statements. Major Policy files and associated investment ledgers, if any.

“The submission of the above mentioned records/documents will facilitate the perusal of their claims and reveal the fairness and transparent position as at close of business before PTAD took over.”