Mohammed Shosanya

Ten members of the House of Representatives under the aegis of Concerned Lawmakers for Economic Stability (CLES),have petitioned the Central Bank of Nigeria (CBN),calling for thorough investigation, audit of GTBank over an alleged 1 trillion Naira fictitious profit, and round-tripping.

Recall that the President of Arewa Consultative Youth Movement, Yusuf Kabiru, had along some interested parties, demanded for a forensic audit of the bank.

Kabiru and his group also urged the suspension of Segun Agbaje to allow for a holistic audit of the institution.

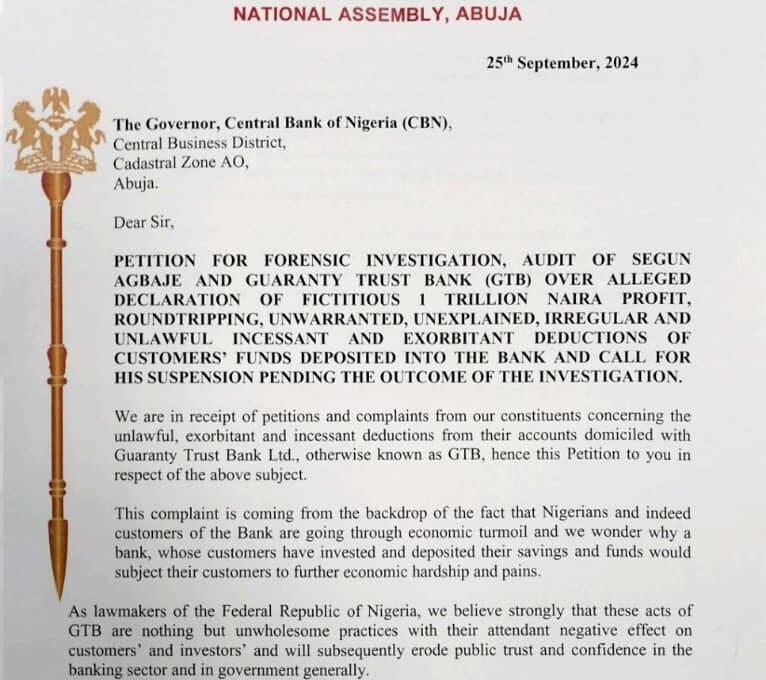

A petition dated 25 September, and addressed to the CBN Governor, Yemi Cardoso, CLES reportedly acknowledged “receipt of complaints from their constituents concerning the unlawful, exorbitant, and incessant deductions from their accounts domiciled with GTbank.”

The petition reportedly signed by Hon. Peter Aniekwe, Hon. Emeka Idu, Hon. Salman Idris, Hon. Joshua Audu Gana, Hon. Afam Ogene and 5 others, the concerned lawmakers, highlighted the effect of the allegations on investors’ confidence.

It also urged investigation into the accusations, as it called on the CBN to invoke its powers in this regard.

The lawmakers emphasized the need for the Apex bank to set up a probe and audit team to look into the records of the institution.

The petition read in part:”This complaint is coming from the backdrop of the fact that Nigerians and indeed customers of the Bank are going through economic turmoil and we wonder why a bank, whose customers have invested and deposited their savings and funds would subject their customers to further economic hardship and pains.

“As lawmakers of the Federal Republic of Nigeria, we believe strongly that these acts of GTB are nothing but unwholesome practices with their attendant negative effect on customers’ and investors’ and will subsequently erode public trust and confidence in the banking sector and in government generally.

“This petition becomes even more expedient given the fact that there have been several petitions by members of the public against Mr. Segun Agbaje, the Group Chief Executive Officer of Guaranty Trust Holding Company Plc and the Bank itself requesting for a forensic investigation and audit bothering on allegations of fictitious reporting of profits amounting to 1 trillion Naira, utilization of family members as fronts for illicit activities, ground-tripping schemes, fraud, corruption. money laundering, economic sabotage, and destabilization of efforts of indigenous companies.

“These allegations are weighty and suggestive of deceptive accounting practices to artificially inflate profit figures and in order cover these schemes, the Bank makes a turnaround move with unwarranted, unexplained, irregular and unlawful incessant: and exorbitant deductions of customers’ funds and the wholesome unethical banking practices that characterize the bank.

“Granted,it is a fact that the Nigerian banking sector, like other sectors of the economy, is going through a very difficult time and this is because, apart from the inflationary effects of Nigeria’s current economic challenges which naturally discourages savings, the spike in the cost of operations amid the current energy crisis and cost of petroleum product is putting undue pressure on banks to significantly cut their cost and grow their revenue.

“However, it is worrisome that most of these customers of these Banks are salary earners, business traders, peasant farmers, artisans and the likes which has further exposed these customers to several degrees of online banking sharp practices.

“The complains suggest that GTB and GICO under the management and leadership of Segun Agbaje not only undermine investors’ confidence but also pose a significant threat to the stability of our financial system and as such requires a swift intervention of your good offices to consider for investigation the unending complaints of customers of GTB of the unwarranted, unexplained, and unlawful incessant and exorbitant deductions of customers” funds, whilst placing Mr. Segun Agbaje under suspension pending the outcome of the investigation in line with your powers under the Central Bank of Nigeria Act.

“It is at the backdrop of the foregoing that we collectively present this petition to your offices for urgent consideration. Accept our assurances of the highest esteem.”