By Zira Maigadi

Simply put, taxation refers to a compulsory charge, fees or levies imposed by Government on its citizens, and or corporations’ income and properties.

Traditionally, taxation is seen as source of revenue to the Government but is far more than that as it is one of the most effective fiscal policy tools used to stimulating growth and stabilization of the economy.

This paper is aimed at analyzing the effectiveness or otherwise of taxation as economic fiscal policy tool.

Taxation can be classified based on tax base, incidence and rate. Therefore, we can have such as Income Tax, Capital Gains Tax, Consumption Tax, Direct and Indirect Taxes, Progressive, Proportional and Regressive taxes.

As earlier mentioned, the role of taxation is broad and not limited to source of revenue as wrongly perceived. Some of its roles include:

• To raise revenue for government

• To regulate the production of certain goods and services

• To regulate the consumption of certain goods and services

• To control monopoly

• To curb inflation

• To reduce income inequality

• To correct balance of payment issues

• To protect domestic industries

• To control and influence economic and social behaviour

All the above have great impact on the economy as a whole and the ability to balance their competing demand will have a positive impact on economic stabilization.

To have proper understanding of tax imposition and collections, we need to know the basic principles of taxation which includes but not limited to the followings:

• Equality – Fairness in the distribution of tax burden among taxpayers

• Certainty-Tax payable ought to be certain and not arbitrary. The time, amount to be paid, basis of assessment ought to be clear to the tax payer or any independent person.

• Convenience of the mode and timing of payments

• Simplicity-Tax system should be simple, straightforward to understand. This reduces non compliances

• Flexibility- Should be flexible enough to adapt to changing economic environment.

For this paper, our attention will be on the effect of taxation as a fiscal policy tool on the economy. It is a well-known fact that tax is the financing side of fiscal policy.

When taxes are increased, the disposable income of individuals are reduced which leads to reduced aggregate demand and thus slows production due to low level of demand.

As for corporate organisations, the higher the tax level, the lower the funds available for investment and expansion of production. In this case where the economy is hyper growing ( boom) and the need to control such growth for sustainability, tax increases as a fiscal policy could be used.

On the other hand,where the economy is in depression, expansionary fiscal policy is to be adopted through reduction in taxes leading to increased disposable income and aggregate demand.

Unfortunately, our tax system is arbitrary and on stand alone sole aim of raising revenue and getting as much as possible collection cost running into billions.

Burden of tax otherwise known as shifting of tax burden is so common in Nigeria such that aims of such taxes are eroded by the ripple negative effects on the citizens.

A good example is the Vat tax, sales tax or even consumption tax. Once imposed or increased, producers and businessmen often pass on the entire tax to the final consumers. Where there is no substitute, consumers are forced to buy at a higher price resulting in a reduced purchasing capacity and welfare. It also widens the inequality in the society.

Multiple taxations- By far this is the most devastating effect on the economy. The regime of multiple taxation in Nigeria is better imagined than known. Some state Government do not even recognize tax clearance from another state and once you have any official transactions, you are required to pay a flat rate tax irrespective of the tax clearance you got from your state!

Equally too, Local Governments use thugs to harass and maim citizens even on federal highways in the name of raising revenue. This is prevalent even in the FCT. It is has even become a crime to use Hilux within Abuja as you must pay at least 35k to the Area Council.

Sadly, most of these funds raised are never accounted for. In some Local Government, the internally generated revenue is used by the Chairman as upkeep allowance

Rigid tax laws application: This is in respect to the Federal inland revenue services and the various State Revenue Boards. Nigeria has witnessed spiral inflation over the years. Example in the downstream sector of the petroleum industry, where price of PMS shot up from =N=N97 to =N=650 per liter while the margins are either reducing or at best constant.

However, the tax authorities will wickedly apply tax on turn over. Simple example will suffix. A trailer load of PMS 50,000 liters. The turnover at 97 is =N=4,850,000; with a taxable income of approximately =N=50,000. Tax at a rate of say 30% would be =N=15,000 (30% of 50,000) while on turnover at 0.5% is =N=24,250.00. the tax authorities will go for the higher which is calculated on turnover.

However, with increase in PMS price to=N=650, the new turnover in 2022-23 would be about =N=32,500,000 and minimum tax at .5% is=N=162,500! An increase of over=N=138,250 and the business could not make such profit. Tax authorities knowing this loopholes negotiate with taxpayers to the detriment of the economy and the business entity.

In accounting,there is a principle of inflation accounting that entails reflecting the current numbers in hyperinflationary business environment which would have taken care of the tax.

This is not done by the taxation authorities in Nigeria. While revenue to Government is increasing, businesses are grounded and if not well managed will lead to recession!

Collection of tax as a target driven process. All the Nigerian MDA involved in collecting revenue one way or the other have turned into commercial banks of yesteryears where deposit mobilization targets were given as a pre-condition for promotion. This contributed in no small in the collapse of the banks witnessed in 90s.

In the same principle, the rate at which MDAs and tax authorities drive tax and revenue collection have made useless the very canon and foundation of good tax system. Government should be increasing the tax base and not over taxing existing taxpayers to increase revenue!

In the main therefore tax system in Nigeria at all levels are geared towards raising revenue for government and individuals relegating to background the fiscal policy and stabilization role. This explains why monetary policies are not effective as the fiscal policies are counterproductive.

To mitigate against these serious situations the followings areas are recommended for consideration.

1. Targets for taxation and revenue generating authorities should be discontinued and let the tax laws be followed to the latter

2. Checkmating corruption and corrupt tendencies in the entire tax system applying instant punitive measure to erring staff.

3. The budget of tax authorities should be subjected to approvals by supervisory ministries or organ and not left to them

4. Tax education and sensitization

5. Taxation should be seen a potent fiscal policy tool and not just revenue source to government. Effort should be made to strike a balance.

6. The Joint tax Board should have an enlarged meeting with Governors in attendance and streamline various taxes to eliminate multiple taxes.

Though tax is a desirable source of revenue to Government, the negative impact of arbitrary taxes and multiplication of taxes have so far outweighed the benefits. Government should consciously balance the competing roles of taxation in the economy particularly its fiscal policy tool.

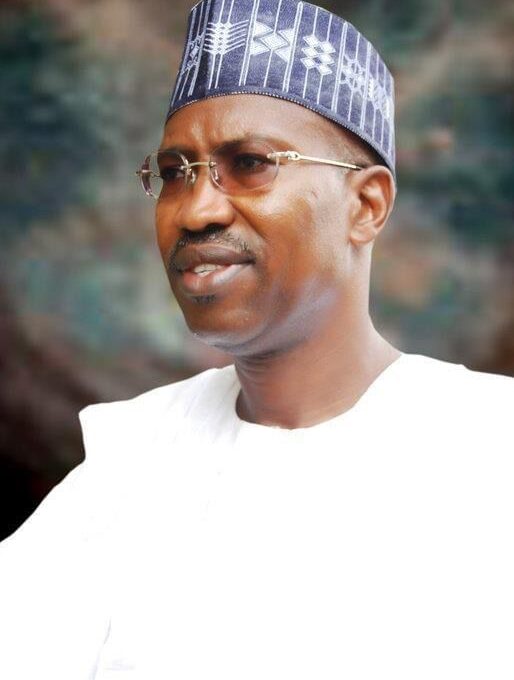

Zira Maigadi,was the former MD/CEO of African Petroleum Plc and Sahara Oil and Gas