All Posts in "Day: March 8, 2022"

Our Move On ExxonMobil Assets Acquisition Intact, Says Seplat

DisCos Defend Obligations On Customer Metering Requirements

Oil,Gas Sector Contributed 8.2% To Nigeria’s GDP In 2020 – NEITI

CBN To Manufacturers :Don’t Take Dollar Loans

Group Decries Electricity Supply Hitch, Fuel Scarcity

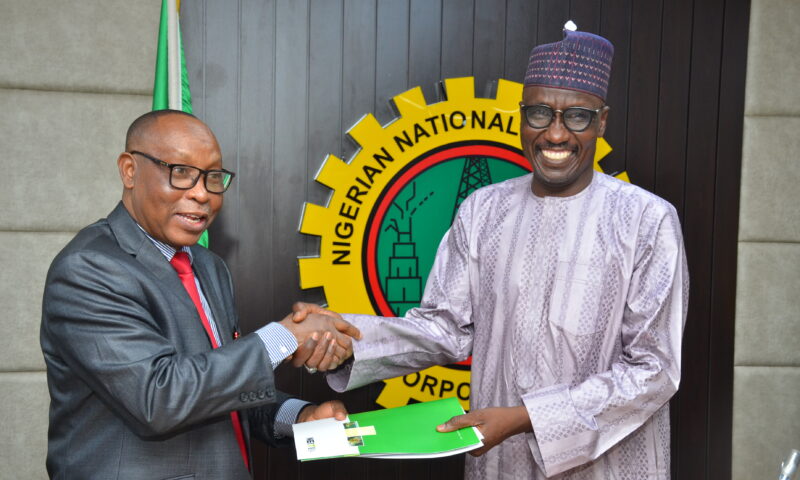

NNPC Explains Interest In Power Plants,Gets Varsity Students’ Support To Stop Fuel Scarcity

World Bank Mobilizes $700 million Support Fund For Ukraine

The World Bank Board of Executive Directors has approved a supplemental budget support package for Ukraine, called Financing of Recovery from Economic Emergency in Ukraine – or FREE Ukraine – for $489 million.

The package approved by the Board consists of a supplemental loan for $350 million and guarantees in the amount of $139 million and is also mobilizing grant financing of $134 million and parallel financing of $100 million, resulting in total mobilized support of $723 million.

The bank said the support will help the government provide critical services to Ukrainian people, including wages for hospital workers, pensions for the elderly, and social programs for the vulnerable.

The initial World Bank support was increased with guarantees from the Netherlands for 80 million euros ($89 million equivalent) and Sweden for $50 million.

The World Bank has also set up a multi-donor trust fund (MDTF) to facilitate channeling grant resources from donors to Ukraine, with contributions from the UK, Denmark, Latvia, Lithuania, and Iceland in the amount of $134 million thus far. The World Bank is calling for further grant contributions to the MDTF. In addition, Japan is linking $100 million in parallel financing to the support package.

“The World Bank Group is taking quick action to support Ukraine and its people in the face of the violence and extreme disruption caused by the Russian invasion,” said World Bank President David Malpass. “The World Bank Group stands with the people of Ukraine and the region. This is the first of many steps we are taking to help address the far-reaching human and economic impacts of this crisis.”

The World Bank Group is preparing a $3 billion package of support for Ukraine in the coming months and additional support to neighboring countries receiving Ukrainian refugees.

According to UNHCR, since the onset of the invasion, 1.7 million Ukrainians – primarily women, children, and elderly – have fled to neighboring countries. Medium and long-term support will be needed for the provision of public services, both for refugee and host communities, and labor market access for refugees.

The World Bank’s overall portfolio of projects in Ukraine supports improvements in basic public services, in areas such as water supply, sanitation, heating, power, energy efficiency, roads, social protection, education and healthcare, as well as private sector development. Since Ukraine joined the World Bank in 1992, the Bank’s commitments to the country have totaled more than $14 billion in about 90 projects and programs.